Don’t Make these 8 Common First Time Home Buyer Mistakes

Buying your first home will no doubt be simultaneously exciting and stressful. It’s easy to get caught up in the whirlwind of the home buying process, and fall prey to common financial mistakes. The average age of a first time buyer is 32 years, and while you may have a solid grasp on items like student loans or credit cards, buying a house is a whole other ball game. So before you take the next step, learn about these 8 first time home buyer mistakes, and how to avoid them.

Avoid these home buying mistakes

1. Only talking to one lender or real estate agent.

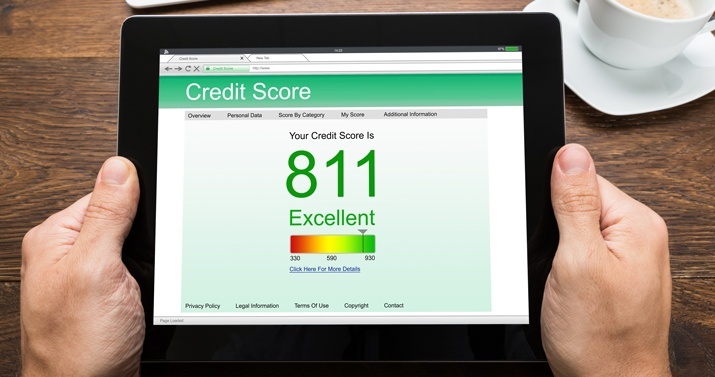

2. Forgetting to evaluate your own credit score.

2. Forgetting to evaluate your own credit score.

These professionals can make or break your home buying experience. Some home buyers don’t research or shop around to find an agent or lender that feels like the right choice. Look for someone who takes the time to explain the process to you, listens to your specific needs, and is able to offer you the best rates and loan terms.

3. Looking at homes before you’re pre-approved.

Have you been regularly checking your credit report and score? If not, you may be surprised – and not in a good way – when you go to apply for a mortgage. Conducting an audit of your finances a few months before house hunting will allow you to check that there are no errors on your credit report, and give you time to rehab your credit score before visiting your lender. You can request a copy of your credit report from each of the three major credit bureaus for free from AnnualCreditReport.com.

4. Not budgeting for any home costs besides the mortgage payment.

4. Not budgeting for any home costs besides the mortgage payment.

The housing market can move quickly, and if you fall in love with a home before being approved from a qualified lender, it’s highly unlikely any offer you make on that house will be accepted. Sellers need to be able to take your offers seriously, and the only way they can do that is if they know your finances will support that offer. Don’t go shopping until you hire a real estate agent, and get pre-approved for a mortgage at your chosen lender.

Home insurance – Does your home reside in a flood plain and need additional flood insurance?When your lender pre-approves you for a specific loan amount, that doesn’t mean you should buy a house that costs just as much as your pre-approval. There are many hidden costs of homeownership that are not accounted for in a pre-approval, and it is your responsibility to budget accordingly. Some examples of these hidden costs may be:

Home insurance – Does your home reside in a flood plain and need additional flood insurance?When your lender pre-approves you for a specific loan amount, that doesn’t mean you should buy a house that costs just as much as your pre-approval. There are many hidden costs of homeownership that are not accounted for in a pre-approval, and it is your responsibility to budget accordingly. Some examples of these hidden costs may be:

- Property taxes – Depending on location, your taxes could vary greatly.

- Utilities – Homes are usually larger than apartments, so budget for heating, cooling, water, electricity, etc.

- Closing costs – Closing on a home can get expensive. Budget for home appraisals, inspections, escrow fees, etc.

- Moving costs – If you hire a mover, this expense can add up quickly.

5. Buying simply to make an investment.

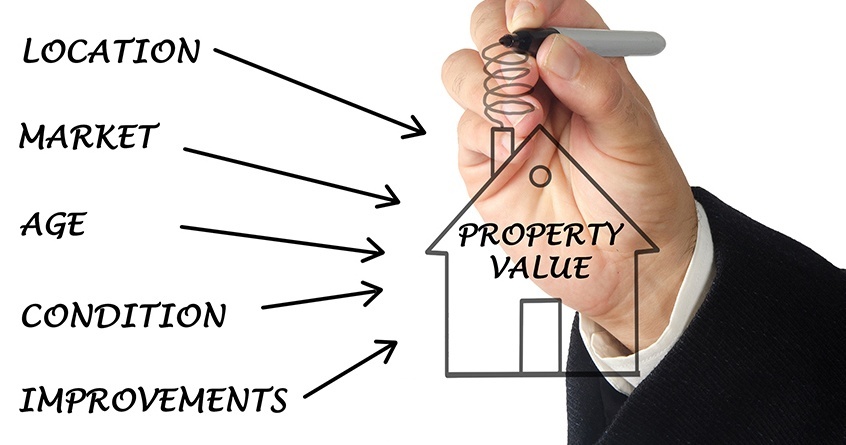

6. Not considering the resale value.Buying a house is often looked at as a smarter investment than renting an apartment. However, that often depends on your specific financial situation. If you don’t have a large emergency fund, aren’t able to budget for additional maintenance, insurance, tax costs, or don’t have any down payment saved up, it’s best to wait to buy a home until you’re prepared. Not to mention, the housing market can be volatile – just ask anyone who bought right before the recession in 2007. The smartest move is to think of your house as your home and not a stock market portfolio.

6. Not considering the resale value.Buying a house is often looked at as a smarter investment than renting an apartment. However, that often depends on your specific financial situation. If you don’t have a large emergency fund, aren’t able to budget for additional maintenance, insurance, tax costs, or don’t have any down payment saved up, it’s best to wait to buy a home until you’re prepared. Not to mention, the housing market can be volatile – just ask anyone who bought right before the recession in 2007. The smartest move is to think of your house as your home and not a stock market portfolio.

7. Assuming the deal is done before closing.On the flip side, while you don’t want to buy for the specific intention of investing, resale value should not be ignored. Chances are, you will move to another home in your lifetime, so you’ll want to evaluate if the location and property will appreciate or depreciate in value. Ask for your real estate agent’s advice on this one, and they’ll be able to tell you what the housing market looks like for your chosen home and location. For example, a 3-bedroom home will often sell much quicker and for a higher price than a 2-bedroom home. Also, if you’re located in a stellar school district, home values will be much more stable and likely to appreciate than if you’re in a less desirable location.

7. Assuming the deal is done before closing.On the flip side, while you don’t want to buy for the specific intention of investing, resale value should not be ignored. Chances are, you will move to another home in your lifetime, so you’ll want to evaluate if the location and property will appreciate or depreciate in value. Ask for your real estate agent’s advice on this one, and they’ll be able to tell you what the housing market looks like for your chosen home and location. For example, a 3-bedroom home will often sell much quicker and for a higher price than a 2-bedroom home. Also, if you’re located in a stellar school district, home values will be much more stable and likely to appreciate than if you’re in a less desirable location.

Another mistake to avoid before closing is making any other major purchases that could change your credit score. If you buy a car between signing the contract and closing, it will likely be a red flag to lenders and you could ultimately be denied the home. Hold off on any major purchases that require financing until after closing.While you may have signed a contract with the seller, normally there is a 30 day window before closing on the home. Don’t assume you’re home free. A home inspection is normally done during this time, and can reveal major issues with a home. Be prepared to back out of a contract if those issues cannot be resolved before closing, the seller refuses to offer any type of credit towards fixing those issues, or if those issues are too much for you to tackle.

Another mistake to avoid before closing is making any other major purchases that could change your credit score. If you buy a car between signing the contract and closing, it will likely be a red flag to lenders and you could ultimately be denied the home. Hold off on any major purchases that require financing until after closing.While you may have signed a contract with the seller, normally there is a 30 day window before closing on the home. Don’t assume you’re home free. A home inspection is normally done during this time, and can reveal major issues with a home. Be prepared to back out of a contract if those issues cannot be resolved before closing, the seller refuses to offer any type of credit towards fixing those issues, or if those issues are too much for you to tackle.

8. Falling in love.

The next step in the home buying processIt’s only natural for emotions to play a role in such a major financial purchase. The trick is to maintain perspective throughout the home buying process so that you don’t overlook any red flags just because you fall in love with a home. If you have a specific list of requirements before you go home shopping, seriously evaluate if the home you fall in love with meets those requirements. Don’t ignore your real estate agent if they tell you the house is overpriced or in a bad neighborhood, and definitely don’t ignore any problems the home inspector brings to your attention. That shiny, happy feeling will wear off – make sure your home still meets your needs when it does.

The next step in the home buying processIt’s only natural for emotions to play a role in such a major financial purchase. The trick is to maintain perspective throughout the home buying process so that you don’t overlook any red flags just because you fall in love with a home. If you have a specific list of requirements before you go home shopping, seriously evaluate if the home you fall in love with meets those requirements. Don’t ignore your real estate agent if they tell you the house is overpriced or in a bad neighborhood, and definitely don’t ignore any problems the home inspector brings to your attention. That shiny, happy feeling will wear off – make sure your home still meets your needs when it does.

Now that you know which financial mistakes to avoid, it’s time to learn about the rest of the home buying process. Preparation and patience is key. Do your research and make sure your finances are in order, and you’ll be ready to leap on the right house when you see it. Download our free First Time Home Buyer’s Guide to learn about all of the other vital steps in the home buying process. Read the guide now and get the best home buying tips on the market!

Now that you know which financial mistakes to avoid, it’s time to learn about the rest of the home buying process. Preparation and patience is key. Do your research and make sure your finances are in order, and you’ll be ready to leap on the right house when you see it. Download our free First Time Home Buyer’s Guide to learn about all of the other vital steps in the home buying process. Read the guide now and get the best home buying tips on the market!

-2.png?width=300&height=65&name=AFCU-logo-2019-white-sm%20(1)-2.png)