How to Avoid Consumer Fraud for PA Residents

With consumer fraud on the rise, how can you effectively protect yourself? The first step is to know the facts. We’ve compiled information about consumer fraud protection in Pennsylvania so that you can take that first step. Plus, find out how to avoid popular forms of fraud and get resources that are available to PA residents.

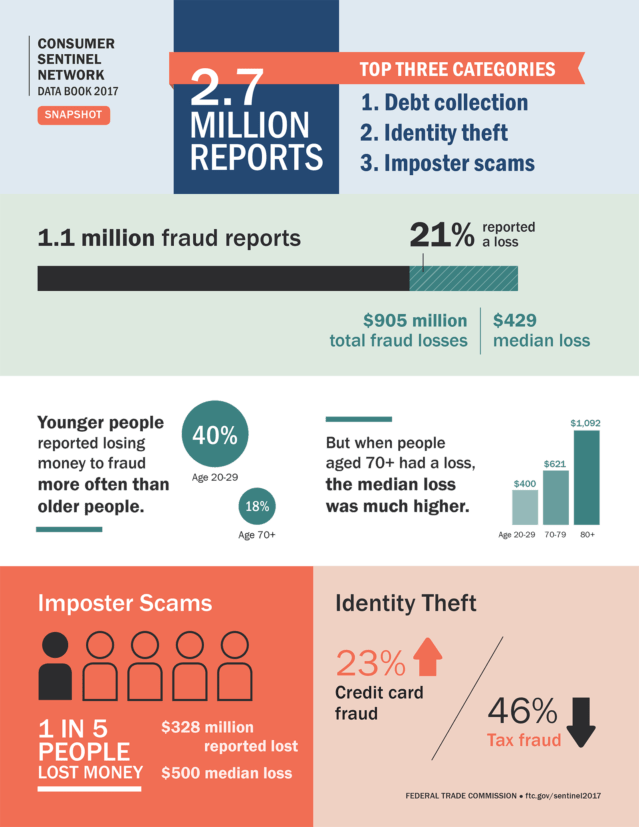

Pennsylvania Fraud Statistics from the 2017 Consumer Sentinel Network Data Book

- The highest number of reported fraud categories were debt collection (22%), identity theft (15%), and imposter scams (12%)

- Pennsylvania ranked 21st in the nation for fraud reports per 100K population

- The total number of fraud and other reports equaled 71,771

- The total number of fraud losses equaled $20.7 million

- The median fraud loss per reporter was $408

- The most common types of identity theft schemes were credit card fraud (42%), phone or utilities fraud (19%), and employment or tax-related fraud (17%)

- Pennsylvania ranked 17th in the nation for identity theft reports per 100K population

- The total number of identity theft reports equaled 12,468

Compare these statistics to some of the national averages reported by the Consumer Sentinel Network.

Protect Yourself from Common Consumer Fraud Schemes

Debt collection

It can be scary to receive a call that you owe money. While debt collection is a legitimate business, there are plenty of scam artists who resort to illegitimate schemes relating to debt collection. Watch out for these warning signs:

- The collector uses scare tactics, like threatening you with a lawsuit or jail time, to try to get you to pay immediately

- The collector requests that you pay through untraceable channels, like wire transfers, rather than traceable channels, like checks or credit cards

- You don’t recognize the account they say you owe, and refuse to send you proof that the account belongs to you

- You look up the collector’s business and/or phone number and can’t find a legitimate business attached to their name or number

- They want you to tell them personal information that they should have, like account numbers or social security numbers

- You can’t find a record of the debt on a copy of your free credit report

Read more about how to handle debt that reaches collection here.

Identity theft

These criminals use your identity information for a variety of unsavory reasons including, emptying your bank account, maxing out your credit cards, opening utility accounts, getting your tax refund, or getting medical treatment on your insurance.

IdentityTheft.Gov lists these clues as warning signs that you’ve been a victim of identity theft:

- You see bank withdrawals on your account that you didn’t make

- You aren’t receiving your bills in the mail

- You are getting calls from debt collectors about debt you didn’t incur

- Your credit report has unfamiliar charges or accounts

- You are billed from your insurance for a treatment you didn’t receive

- The IRS tells you more than one tax refund was filed in your name

They also provide a list of what to do if specific identity information has been lost or stolen. We also have 6 more tips on how to protect your identity.

Imposter scams

The basis of an imposter scam is that the scammer poses as someone you think you trust and convinces you to send them money. These scammers may pose as:

- Employers of nannies or caregivers who want you to pay upfront for medical equipment

- Family members in an emergency who ask you to send them cash to help get them out of that emergency

- IRS officials who say that you owe taxes and must pay to avoid jail or legal proceedings

- A tech support agent who says he’s calling to fix your computer equipment

- A love interest on an online dating site that suddenly needs money from you

Be wary of any calls or emails that ask you to make a wire transfer or want you to send the money immediately without independently confirming their information.

Resources Available to PA Residents

You can submit consumer complaints to the attorney general and get access to dozens of resources about consumer safety. They also have multiple fraud-related helplines anyone can call. We’ll list those numbers below.

Senior Protection – 866-623-2137

Consumer Protection- 800-441-2555

Public Engagement – 800-525-7642

Health Care – 877-888-4877

Do Not Call – 888-777-3406

Military and Veterans Affairs – 717-783-1944

Home Improvement Consumer – 888-520-6680

You can also enroll in PA’s Do Not Call List here. This list will drastically reduce the number of calls you receive from telemarketers.

PA Department of Banking and Securities (DOB)

File complaints with the department here. In addition to consumer complaints, the DOB provides resources for how to properly investigate a financial service, product or company before doing business with them.

National Credit Union Administration (NCUA)

The NCUA has an entire office devoted to consumer financial protection. On their online consumer assistant center you can file a complaint, ask questions, and find valuable advice on how to avoid fraud.

Better Business Bureau (BBB)

Use this resource to file complaints, and find out the latest fraud schemes they’ve identified in the U.S.

Internet Crime Complaint Center (IC3)

This site was created by the FBI to monitor white collar crimes that occur specifically online. You can file a complaint about the crime directly on the site.

Have any questions?

If you have any specific fraud-related questions, please leave them in the comments below. Our experts will be happy to help you find the best course of action.

Benefits Plus Program through AmeriChoice

Our members can sign up for our exclusive Benefits Plus program that includes identity theft protection in addition to discounts. In the event your identity is stolen, you’ll have a team of licensed attorneys who specialize in identity theft recovery available through Benefits Plus to provide you comprehensive support to resolve your situation. If you’re a member of AmeriChoice, you can visit any of our locations to sign up. Get more details here.

-2.png?width=300&height=65&name=AFCU-logo-2019-white-sm%20(1)-2.png)