5 Surprising Statistics about Borrowing Equity in your Home

We found some really interesting statistics we want to share with you! These 5 stats could help you decide whether to borrow equity against your home, and what method of leveraging equity works for your situation.

1. 42 million homeowners with outstanding mortgages have built-up equity in their home. (Source)

You can leverage your home’s equity for so many reasons, including:

- Home repair

- Home renovation

- College tuition

- Debt consolidation

- Medical bills

- Weddings

However, even though equity has recovered from the recession, there’s still a disconnect between the amount of people that could use it, and the amount that actually do use it.

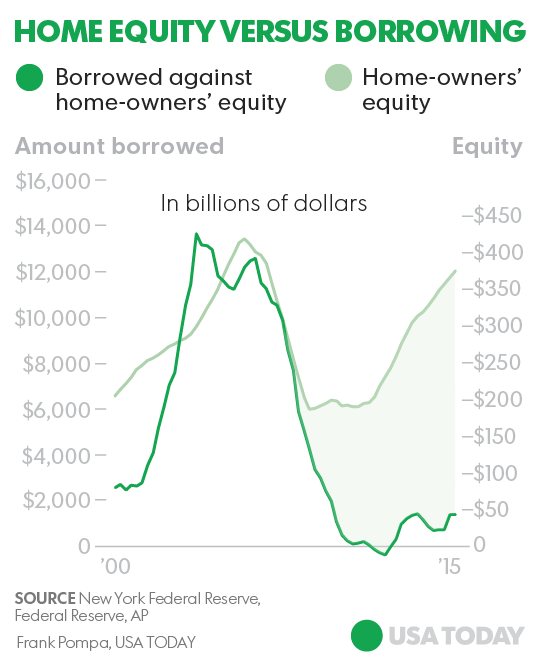

2. The amount of usable equity in the U.S. is estimated at 5.5 trillion dollars, up more than 3 trillion from 2012 when the market had bottomed out. (Source)

Usable equity is the amount a homeowner could borrow before they hit that 80% debt-to-value ratio. Financial institutions want to make sure you don’t borrow more than you owe or borrow more than your home is worth. They calculate your equity with this simple equation:

The value of your property – The amount you owe on your primary mortgage = Your potential equity

3. Mortgage application volume, including refinance applications, were up 6.1% higher in January of 2018 v. January of 2017. (Source)

Some speculate that mortgage rates are rising, so many applicants may be trying to get in before the upward trend.

There are multiple ways to tap into your equity, including cash-out mortgage refinances, home equity loans, and home equity lines of credit. The option you pick depends on interest rates, your lender, and more.

Get the breakdown between a home equity loan and line of credit here.

4. 80% of homeowners with existing HELOCs would consider using their equity to fund home renovations. (Source)

While renovations were the most popular HELOC use, the other top two uses were emergency expenses and educational expenses. Not to mention that 85% of those with existing HELOCs thought the process of borrowing was easier than they expected. Any homeowner with equity in their home can leverage that equity – just find a lender you trust to walk you through the process.

5. The new tax bill eliminated deductions on the interest paid to home equity loans.

This will likely increase the number of homeowners who choose to leverage equity through a cash-out mortgage refinance versus home equity loans. However, there are definitely still instances where a home equity loan or line of credit could be more beneficial. As always, we recommend consulting with a mortgage expert to decide which option would be best for you.

-2.png?width=300&height=65&name=AFCU-logo-2019-white-sm%20(1)-2.png)