5 Smart Ways to Spend Less on College Tuition

Are you nearing the end of high school and starting to question how you’re going to pay for a college education? The average college tuition per year keeps increasing, but there are strategies you can start working on now to reduce the overall cost. Keep reading to find out how every teenager can spend less than average on a college degree!

What is the current average college tuition per year?

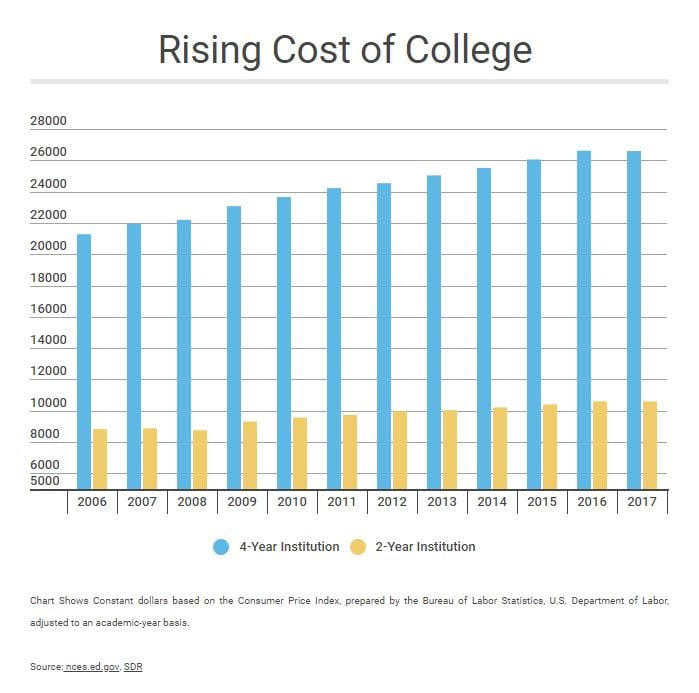

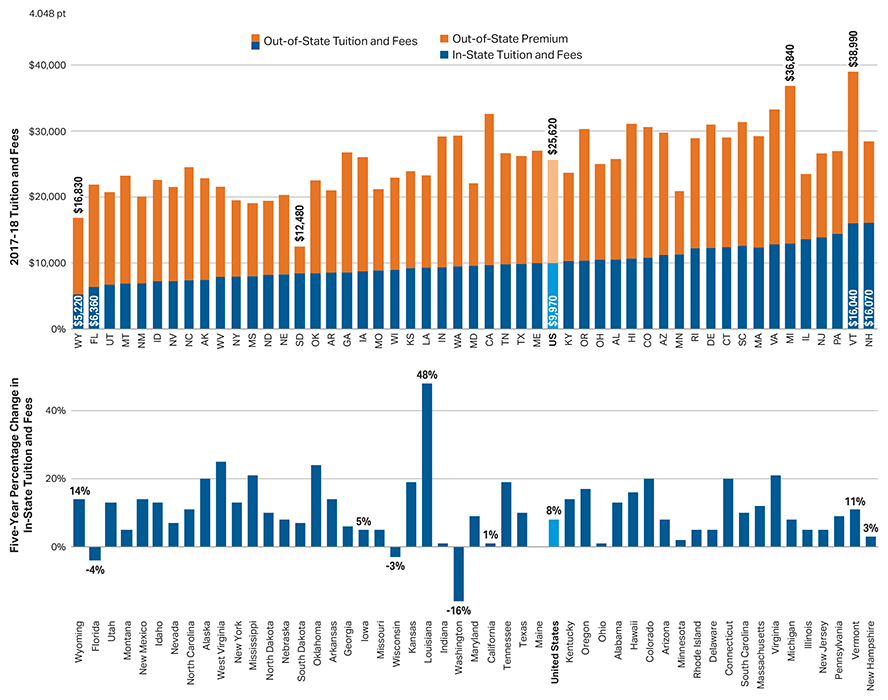

Associate degrees cost less than bachelor’s degrees. Students paid an average of $3,570 per year at public 2-year schools and $14,587 at private 2-year schools. But these numbers don’t account for living expenses. Many students commute to their 2-year school. According to the National Center for Education Statistics, living at home averages $3,939 and living off-campus with roommates or on your own averages $8,235. Transportation costs for commuters are estimated at $1,780 per year.College tuition continues to increase year after year. StudentDebtRelief estimates the average college tuition at a 4-year private college in the 2017—2018 school year is $34,740. If you add room and board to tuition, the cost jumps to $46,950. Public university averages, not including room and board, are at $9,970 for in-state students and $25,620 for out-of-state students. Tack on $10,800 to each of these numbers for room and board.

Here’s a breakdown of all average costs:

4-year schools per year

- Private w/ room & board – $46,950

- Private tuition only – $34,740

- Public in-state w/ room & board – $20,770

- Public out-of-state w/ room & board – $36,420

- Public in-state tuition only – $9,970

- Public out-of-state tuition only – $25,620

2-year schools per year

- Public school while living at home – $9,289

- Private school while living at home – $20,306

- Public school living on your own – $13,585

- Private school living on your own – $24,602

5 ways you can spend less than average on college

There are specific ways teenagers planning to attend college within the next few years can reduce these average costs. Use these tips to save money on your future education and get the best value on the money you do spend.

1. Take advanced placement courses in high school.

Does your high school offer advanced placement (AP) courses? These are college-level courses that include an option to test out of taking the same course in college. If you pass the exam, most colleges will give you credits that count towards graduation. It’s like getting a head-start on your college education. With the average cost of a college credit around $600, that’s serious money you could save.

2. Apply for as many scholarships as you can.

Scholarships are FREE money. Once you receive this money, there is no requirement to pay it back like there is with student loans. It may seem overwhelming to apply for scholarships while in high school, but it is absolutely worth it. Every free dollar you receive is one less dollar you may have to take out a loan for.

In our guide to affording a college degree, we listed our top four tips for finding scholarships.

1) Talk to your high school’s counselor. One of their job duties is to help students search and apply for scholarships. They will have an extensive library of options and some of the best knowledge of local businesses and organizations that offer this free money.

2) If you’ve narrowed down where you want to attend college, reach out to their financial aid office. Many colleges offer their own scholarship programs to incoming students. They can also direct you towards scholarships that past attendees have received.

3) Ask your employer if they offer any scholarships to employees. More businesses are setting up scholarship funds every day to help out their younger work force.

4) Research online. There are countless websites built solely around curating scholarship opportunities for potential applicants. While many require you to set up a profile, this helps them narrow down what scholarship criteria you meet. They can then focus on showing you scholarships that you may be qualified to receive.

3. Make sure you or your parents fill out the FASFA.

FASFA stands for free application for student federal aid. Every high school student should fill out the FASFA before their first year, and for each year they plan on attending school. This application will determine how much federal aid you qualify to receive. This includes Pell grants, Stafford loans, PLUS loans, and work-study programs.

This can save you money because you could qualify for grants or federal lending opportunities. Grants are free money like scholarships, with no obligation of repayment. Federal student loans tend to come with lower interest rates and more flexible repayment terms than private loans.

Find out how to apply for the FASFA here.

4. Price the actual cost of your top schooling choices.

2017-18 Tuition and Fees at Public Four-Year Institutions by State

Public vs. Private

To spend less money on a college education, include these factors when you decide which school to attend.

Is the school public or private? Public schools are generally less expensive.

In-state vs. Out-of-State

Is the public school in-state or out-of-state? If you want to attend a public school that isn’t in the state you live, you will pay more. In the above graph, the blue in for in-state and the large orange block on top is the additional out-of-state fees.

Tuition Assistance

What tuition assistance is offered? Different schools will offer you varying degrees of financial assistance. You could save more money by choosing a school that provides greater assistance.

Get the information you need by asking your financial aid office these 13 questions.

Graduation Rates

What are the graduation rates at your school? Tuition fees may be lower, but if graduation percentage rates are also low – you may not save any money. This is because you could either leave school without a degree you could us or it make take you additional semesters to graduate. Those additional semesters will cost you big time.

5. Choose a major with job security and opportunity.

Chances are you will still graduate with student loans, even with reducing the up-front costs. You will need a stable career path to afford repayment. Job growth and job security are both extremely important factors when deciding which college major you’ll pursue.

Forbes shared a list of majors and what percentage of applicants had at least one job offer by graduation. The top three majors were computer science (68.7%), economics (61.5%), and accounting (61.2%).

Business Insider created a list of college majors with the lowest percentage rates of unemployment. The top three were social science or history teacher education (1%), natural resources management (2%), and special needs education (3.11%).

Have Questions about Student Loans?

If you’ve done the legwork to reduce the up-front costs, but still need a private loan after financial aid – talk to our student loan experts. We can help you find the best student loan for your situation. Learn more about AmeriChoice student loans today.

-2.png?width=300&height=65&name=AFCU-logo-2019-white-sm%20(1)-2.png)